Snapshots

Cypriot presidency programme’s priorities (Jan.1 – June 30, 2026)

Competitiveness and Industry

- Simplification and burden reduction to improve the business environment, reduce compliance costs, and foster investment.

- Advancing the Industrial Accelerator Act and Clean Industrial Deal, strengthening strategic value chains and regulatory predictability for energy-intensive sectors.

- Supporting SMEs and energy-intensive industries through better access to finance, digital adoption, and competitiveness assessments.

Energy and Strategic Autonomy

- Building a resilient Energy Union, improving grid infrastructure, interconnections, and energy storage

- Promoting digitalisation and AI in energy systems and advancing the Electrification Action Plan to lower costs and enable renewable integration.

- Reviewing state aid and competition rules to maintain global competitiveness.

Environment and Circular Economy

- Advancing the European Green Deal, Climate Adaptation Plan, and Water Resilience Strategy and preparing the EU Circular Economy Act (2026).

- Modernising REACH chemicals regulation

Funding opportunities

The Presidency will shape the 2028–2034 Multiannual Financial Framework, prioritising competitiveness, energy, research, and industrial resilience important for mining investments.

Policy Updates

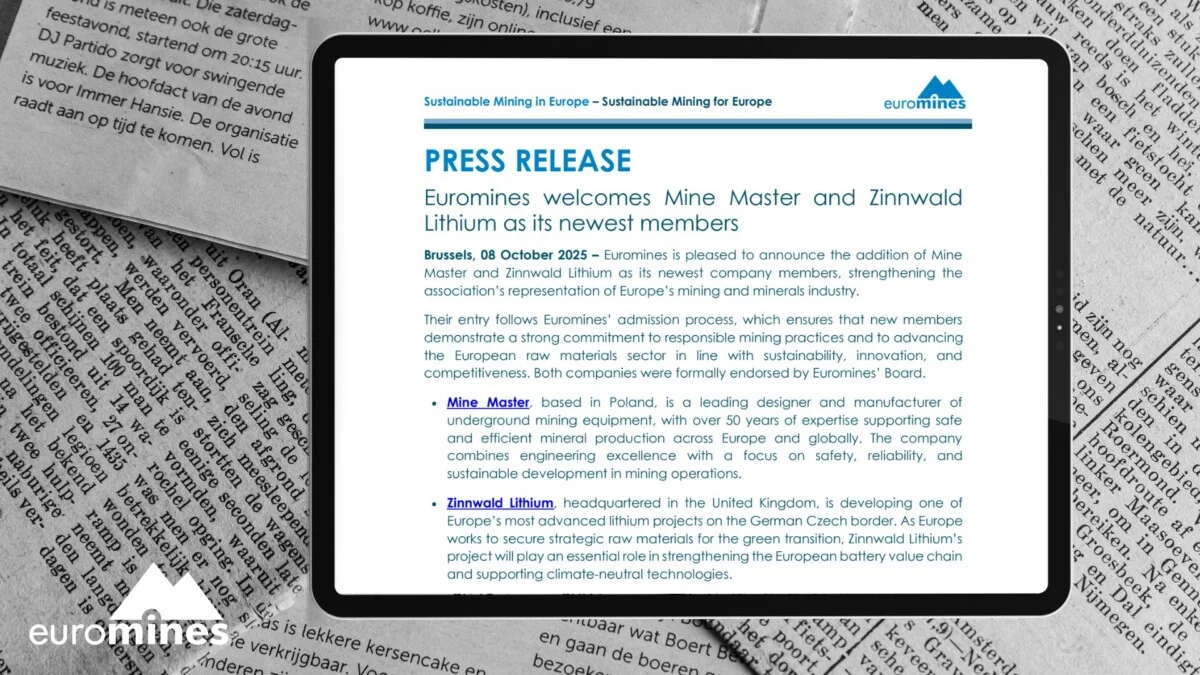

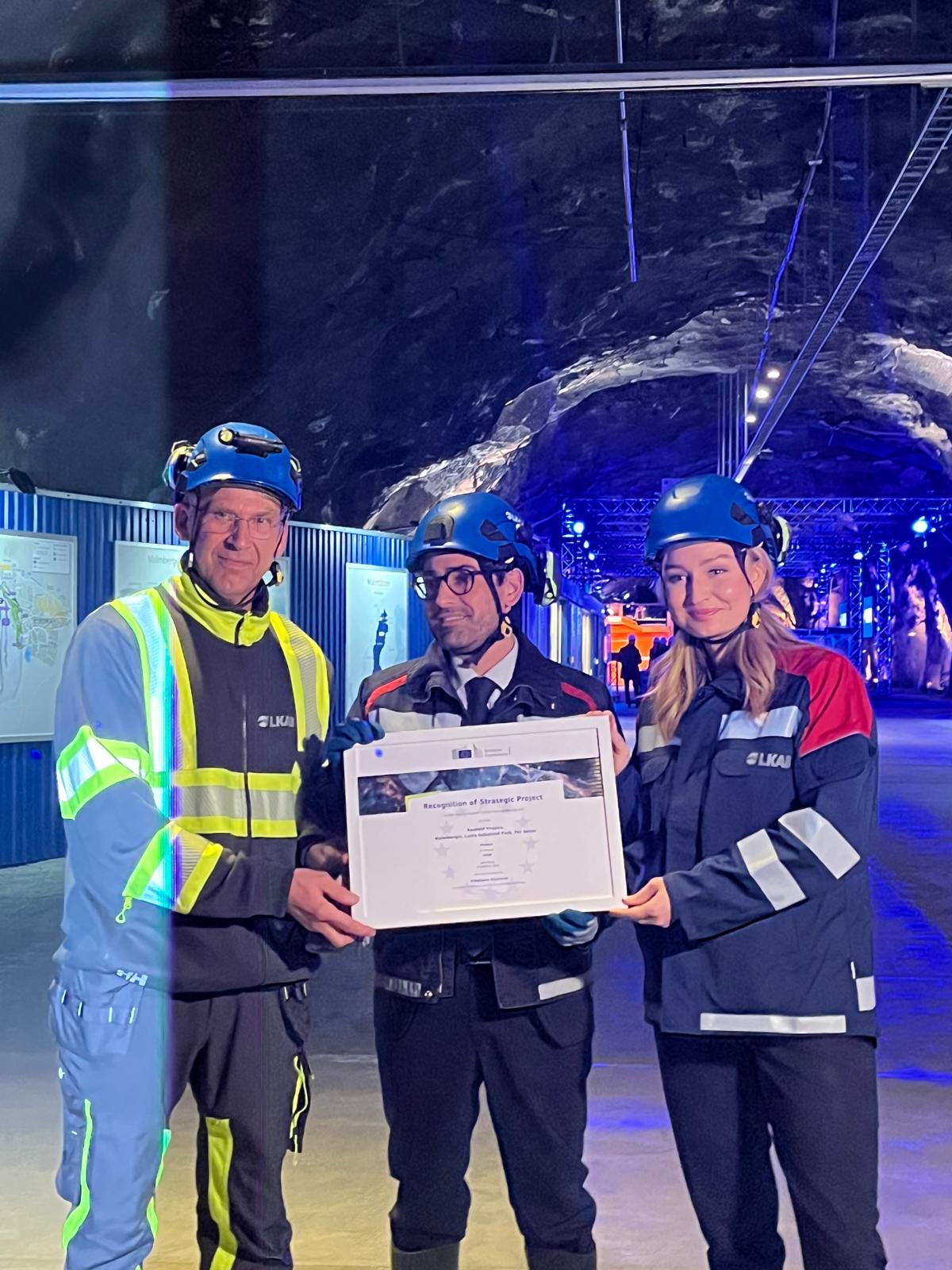

Second round of application for Strategic Projects

The second cut-off date for applications for Strategic Projects under the CRMA was 15 January 2026 (12:00 CET). Projects must demonstrate technical feasibility, expected production volumes, and sustainable implementation.

See the current list of approved strategic projects for examples in practice.

RESourceEU

On 3 December 2025, the European Commission presented the RESourceEU Action Plan (summary), a strategic initiative to secure Europe’s access to critical raw materials, reduce dependencies on battery‑related, rare earth and defence‑critical inputs by 30–50% by 2029, and advance the implementation of the Critical Raw Materials Act (CRMA). The plan introduces a €3 billion financing facility to accelerate Strategic Projects, a CRM Permitting Act to streamline approvals and provide legal certainty, and measures to strengthen market infrastructure through transparent pricing and liquidity support. It also promotes integrated European value chains by clustering extraction, processing and manufacturing capacities, fostering “Made in Europe” solutions, and improving investment conditions through early‑stage de‑risking and guarantee schemes.

Ahead of the publication, Euromines engaged extensively with Cabinets and DG GROW, ensuring several of its key recommendations were reflected in the final plan. These include accelerated permitting for strategic projects, improved access to finance, preservation and expansion of EU primary and secondary raw materials production, strengthened resilience against supply disruptions, and faster diversification of critical raw material supply chains. This outcome marks a significant step forward for Europe’s raw materials sector and demonstrates the impact of coordinated industry advocacy.

Euromines’ Omnibus on Permitting

In October 2025, Euromines published its Omnibus on Enabling Effective Procedures, calling for faster, simpler, and predictable environmental permitting. Key proposals:

- Simplified, outcome-oriented permitting across Member States.

- Balanced implementation between environmental protection and competitiveness.

- Streamlining the Water Framework Directive, clarifying Natura 2000 and Nature Restoration Regulation, revising Industrial Emissions Directive, and avoiding overlaps with the Soil Monitoring Directive.

- Introducing Strategic Zones to fast-track sustainable mining investments.

Energy & Climate

The second half of 2025 was shaped by three major developments for Energy and Climate policy in carbon markets: the launch of discussions on the post‑2030 EU ETS reform, the adoption of the revised indirect cost compensation guidelines, and the review and extension of the Carbon Border Adjustment Mechanism (CBAM). At the same time, energy costs remained high on the European Commission’s competitiveness agenda, notably with the publication of the Clean Industrial Deal (CID) on 26 February 2025 and its subsequent implementation throughout the year.

During this period, Euromines engaged constructively with EU institutions and stakeholders and achieved important milestones to improve the framework conditions for the European mining sector.

The sections below provide a more detailed overview of Euromines’ engagement across these core Energy and Climate policy areas, highlighting key developments, milestones achieved, and the remaining challenges for the sector.

Carbon markets

Indirect Cost Compensation: After four years of intense advocacy efforts on DG COMP and on the relevant Commissioners’ Cabinets, Euromines, supported by its members that advocated their national authorities, DG Competition published the updated Indirect Cost Compensation Guidelines.

The revised guidelines applicable from 2025 to 2030 are a drastic improvement in particular:

- Inclusion of sectors 07.10 (iron ore mining), 07.29 (non-ferrous metals mining), and 20.15 (manufacture of fertilisers).

- Maintaining Indirect Cost Compensation beyond 2030.

- Newly added sectors will qualify for a state‑aid intensity of 75%, while sectors that were already eligible will benefit from an increased rate of 80%.

- Compensation for indirect emissions will become available starting in 2025.

This result is very relevant for the mining sector as Indirect Cost Compensation in absence of a reform of the electricity market design is the most significant support mechanism to support decarbonisation and the uptake of direct electrification.

The EU ETS will face a major post‑2030 overhaul, as the current reduction trajectory would drive the cap close to zero by around 2040. With CBAM progressively replacing free allocation and expanding its scope, industry needs a recalibrated system that safeguards competitiveness while maintaining investment capacity and ensuring carbon leakage protection.

Euromines actively advocated for its position on EU ETS-post 2030 and CBAM through meetings with DG CLIMA and relevant Commissioners’ Cabinets. The ETS revision is expected to be out in July 2026, while CBAM is scheduled to be adapted in scope starting with a proposal in 2028. Euromines’ sees this as an opportunity to ensure maintaining a high level of carbon leakage protection, inter alia by:

- Maintaining free allowances beyond 2030

- Keeping, if not extending, Indirect Cost Compensation, as electricity remains the main commodity to decarbonise, with fossil sources setting the electricity price well into the mid-2030, as showed in this study.

- Pursuing a balanced approach to the CBAM scope extension: while it is a useful tool for some sectors, for others the functioning of the ETS is better suited to support their competitiveness while pursuing climate neutrality.

The revision of CBAM and the report for future inclusion, instead, have been published mid December. Euromines, actively engaged with relevant Commissioners’ Cabinets. As a result:

- Magnesia inclusion in the CBAM scope has been postponed for other two years, until the next report in Q4 2027.

- Goods from mining activities and fertilisers (e.g. potassium chloride) have not been selected for further consideration.

- The Commission has not identified additional relevant precursors for fertilisers beyond those already covered by the current CBAM scope.

- Mining as such remains excluded from the CBAM scope.

On ETS implementation for the second half of the trading period until 2030, Euromines launched a major advocacy campaign to avoid the 50% reduction of the fallback benchmarks, together with other impacted sectors. The foreseen reduction would significantly raise compliance costs for energy-intensive industries and undermine the sector’s decarbonisation investment capacity, competitiveness and would put the objectives of the CRMA, RESourceEU, and NZIA at risk. The revision is expected to be out in April 2026.

Clean Industrial Deal Implementation:

The Clean Industrial Deal (CID), launched on 26 February 2025, aims at strengthening EU competitiveness while accelerating industrial decarbonisation. It focuses on lowering energy costs, boosting clean manufacturing, supporting energy‑intensive industries, and securing access to raw materials.

On of the pillar of the CID, the Industrial Accelerator Act, expected to be published end of February, aims at enhancing competitiveness and productivity for energy-intensive industries. Euromines, throughout the entire year, have been actively working on this topic, engaging with Cabinet of Commissioner Valdis Dombrovski and Cabinet of EVP Stéphane Séjourné, asking to:

- Speed up permitting procedures for industrial decarbonisation.

- Identify and promote priority industrial decarbonisation projects and clusters.

- Create and protect lead markets for European low-carbon products.

Other key initiatives to highlight include the Electrification Action Plan, expected in Q1 2026, aiming at lowering energy prices and strengthening security of supply, and the White Paper on deeper electricity market integration, foreseen in May 2026, which will set the strategic direction for the next phase of EU electricity market reform.

Euromines developed a position paper asking for:

- Reform the market design where electricity producers benefitting from inframarginal rates need to share this responsibility with the off takers.

- Adequate long-term investment support.

- Upgrading infrastructure and streamlining permitting procedures to build up the necessary infrastructure.

Euromines joined also forces with other energy-intensive industries and developed a statement, under the lead of Eurofer, asking to:

- Review the electricity market design

- Introduce a KPI of 50EUR/MWh for the Commission to achieve as the maximum total electricity cost for industry, not sure wholesale price.

Magnesite & Magnesia Assembly

Carbon Markets

Euromines and Assembly members work jointly with Energy Committee members to advocate for our position. On CBAM scope extension, the focus was on avoiding the potential inclusion of precursors (magnesia, potash and metal concentrate) in the CBAM scope. For this purpose, Euromines and members of the Magnesite Assembly actively engaged in meetings with different representatives of DG TAXUD advocating for keeping magnesite and magnesia production in the scope of the ETS as the more appropriate tool to prevent carbon leakage given the myriads of applications in which magnesia is used.

While magnesia and refractories will not be immediately included under the CBAM scope, DG TAXUD provided an outlook for the next scoping-exercise in 2027 (with a follow-up legal proposal on scope-extension in 2028 for a gradual phase-in of CBAM after 2030) to consider Magnesia inclusion either:

- Vertically as a precursor for steel and aluminium precursors, the products considered as feasible for inclusion are calcined lime, dolime, magnesia, alumina.

- And/or as horizontal expansion: DG TAXUD considers it technically feasible to consider including certain shortlisted goods in the CBAM sectors such as pulp and paper, glass, ceramics (including refractories) and ferro-alloys.

The assessment report is expected to be published in Q4 2027. Euromines will engage constructively in the run-up to the report, advocating for structural reviews as to:

- An export-solution to offset carbon prices paid in EU production by granting “negative” CBAM certificates to refund exporters for carbon costs incurred that are not equally priced in their export markets.

- An approach of inclusion, starting with the full range of downstream products first before including stepwise upstream goods to avoid circumvention through resource-shuffling or downstream-good substitution through third-country imports.

- A solution to indirect CO2-costs for electrification taking into consideration the indirect emission costs and widen the eligibility of indirect cost compensation to the production also of mined precursors.

JRC Sevilla

INCITE is a new element of the revision of the Industrial Emissions Directive (IED) to tackle industrial transformation and identifying and evaluating the environmental performance of emerging techniques (ETs). Euromines and several members participated to the 2nd INCITE Workshop in Sevilla (October 2025) dedicated to the CLM sector (cement, lime, magnesia) and their presentations were focused on technical innovation in the magnesia industry. The review of the CLM BREF will start in early 2027 and Euromines, set up and internal Task Force to coordinate our positions and strategy throughout the CLM BREF process.

Magnesite & Magnesia criticality

Euromines’ effort to enter magnesite and magnesia as critical raw materials in the list of the CRM Act continues, supported by the Magnesite & Magnesia assembly. A productive and constructive engagement with DG GROW and SCRREEN3 on data shortcomings in previous assessments supported by data gathering and external studies on magnesia production, consumption and market development in Europe allowed widen the scope of the assessment from magnesite alone to a combined view on magnesite and magnesia. The next phase will keep us busy until September 2026: starting with a data validation workshop in February, the Magnesite and Magnesia assembly will analyse factsheets and provide additional information and engage with the stakeholders involved to consider the critical strategic nature of magnesia for the European raw materials supply base.

Sustainability

The Sustainability Committee’s work in 2025 was marked by simplification and burden reduction across the whole reporting and compliance landscape: CSRD, CSDDD, the Taxonomy. The very first attempt of the Commission to create a simplification omnibus had its starting point around these files – and Euromines engaged as a constructive partner to reduce burden and improve conditions for doing business in the EU. At the same time, global developments took off – with the creation of a Standards Based Markets initiative at G7 level and the Critical Minerals Production Alliance that both provide levers to even the level playing field and ensuring access to finance for responsible and resilient projects

Omnibus I

After intense negotiations, our advocacy efforts, targeting several DGs and relevant cabinets of Commissioners, achieved major improvements for our sector under the first omnibus proposal and the final agreement negotiated by the European Parliament and the Council:

- Sector-specific reporting standards for which mining was singled out have been removed.

- Climate Transition Plans are no longer required.

- Scope adjustment: Companies in scope now include those with 1,000 employees and a €450 million turnover threshold, significantly reducing the number of affected entities. Additionally, listed SMEs are excluded from the directive.

- Wave 1 companies: Large companies will not face any additional phase-ins for 2025/2026. Starting in 2027, only the drastically simplified ESRS will apply.

EFRAG on ESRS simplification

Euromines continued to engage with EFRAG, technical advisor to the Commission for sustainability and financial reporting, on the ESRS revision, as EFRAG has been appointed in March to lead on the simplification effort by Commissioner Albuquerque. Euromines participated to the consultation (DL 29/09) asking for a general simplification of the standards and data reporting with specific requests on individual data points.

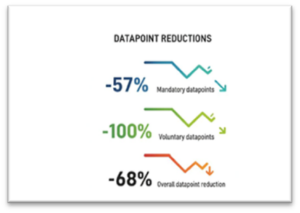

EFRAG’s simplification exercise led to a proposal to the Commission adjusting:

Double Materiality Assessment (DMA):

- Streamlined list of topics no longer mandatory (AR 16).

- Report only material sub-topics.

- Improved aggregation and disaggregation criteria. Clarification that a full DMA is not required annually unless significant changes arise.

- Streamlined list of topics no longer mandatory (AR 16).

- Flexibility to disclose at topic level instead of detailed IROs level when granular reporting is not required

- Reduction of the most granular Minimum Disclosure Requirements (MDRs) under the topical standards and remotion the obligation to justify the absence of Policies, Actions and Targets (PTAs) or to provide timetables for their future adoption, to allow a more concise reporting framework.

- Data point reduction in the topical horizontal standards.

- Better readability and more flexibility to present information by the possibility of including an executive summary at the beginning of the sustainability statement.

- The European Commission is expected to adopt the delegated act by mid-2026. Until then, it will be crucial to closely monitor developments within DG FISMA and other relevant stakeholders to stay ahead of any changes or emerging details.

Euromines actively engages on Standards‑Based Markets, working closely with the OECD as well as with DG TRADE and DG GROW to help drafting a coherent approach in support of a level playing field and increased resilience and transparency of niche-markets to provide tools that help with viability of projects in defence of outpricing practices. Euromines objective is that these initiatives are aligned with the strategic interests of the EU mining sector and ultimately will equip the G7+ (EU, Australia etc.) with tools to ramp up our own raw materials value chains.

On this purpose, Euromines presented a position paper providing input on how a functioning standard-based market for raw materials should focus:

- Guaranteeing access to finance and adequate liquidity.

- Reducing back-end risks for investors, protect from outpricing practices.

- Fostering reliability, price and cost visibility.

- Build trust through more than ESG alone: strong technical requirements, transparent offtake preferences, and credible local‑sourcing commitments all play a key role.

Value Chain Cooperation – a new DG COMP initiative

DG COMP has been working on an initiative to foster cooperation along the value chain to better integrate the demand perspective into existing supply-side policies: after all, without demand, the supply side measures envisaged will not be sufficient to increase the resilience of our value chains.

Euromines stressed that while markets may be functioning, they are not currently operating in Europe’s favour, exposing domestic producers to structural disadvantages. Supply‑side measures alone without a demand perspective is insufficient, so that the set-up requires a more comprehensive industrial policy that considers that global competitors will not reduce production simply because Europe deploys subsidies, premiums, or Buy‑European mechanisms.

Euromines argued that demand integration through cooperation shall eventually lead to a price‑competitive production in the medium term – and must be aligned with the G7 Standards Based Markets initiative. For this, rather than focusing narrowly on each mineral in isolation, the policy approach should centre on the type of industrial ecosystem EU aims to build – and based on this provide a suite of development mechanisms that can be applied in a targeted manner to remedy shortcomings and bottlenecks.

Environment

Circular Economy

The European Commission ran a public consultation on the New Circular Economy Act initiative from 1 August until 6 November 2025. Euromines fed into this round of feedback as well as into the targeted consultation that followed. Euromines’ main asks (see our Position Paper) focused on the needs for a balanced approach between primary and secondary raw materials, to unlock permitting procedures, to make recycling a business case, and on the importance of the “no one-size-fits-all” approach (smart risk-based rules as the Extractive Waste Directive and the BREF for the Management of Extractive Waste should not be touched).

The legislative act will take the form of a Regulation aiming at enhancing resource efficiency and promoting the use of secondary materials. Commission adoption is planned for Q4 2026.

Water

The file related to the Protection of groundwater against pollution and environmental quality standards in the field of water policy (linked to the Water Framework Directive) is reaching near-adoption. The EU co-legislators found an agreement during the fourth trilogue that took place on 23 September (originally scheduled for 15 July). The provisional text will be put for final adoption by the EP on 19 January 2026 (tentative date), while the date of the Council vote is still to be announced. Once adopted, Member States will be required to transpose the directive by 21 December 2027. Despite intensive industry advocacy to raise awareness and improve the Water Framework Directive via this file, the trilogue agreement strengthens the “non-deterioration” definition and introduces only 2 very limited derogations.

However, Euromines’ advocacy efforts were echoed. The Commission’s RESourceEU Action Plan published on 3 December 2025 foresees the release of a guidance document in Q1 2026, to enable a simpler and more harmonised implementation in Member States of the EU law on environmental permitting, including aspects related to water and the mining sector. The Commission will also review and revise the Water Framework Directive by Q2 2026. Euromines is preparing input and outreach for both initiatives.

Soil Monitoring Law (SML)

After the co-legislators’ provisional agreement in April 2025, Council adopted the SML text on 30 September 2025. Ahead of the EP ENVI vote of 20 October, Euromines and other associations reached out to MEPs, pushing them to reconsider the SML in view of the EU simplification efforts. The text was eventually formally adopted in EP Plenary on 23 October and published in the EU Official Journal on 26 November. Member States will have three years for transposition into national legislation (until late 2028).

Overall, Euromines notes significant improvements in the SML compared to the initial proposal. It leaves more flexibility for implementation at Member State level, recitals clarify that permitting procedures will not be hampered, and provisions are more realistic (no one-out-all-out principle, non-binding sustainable target values at EU level, consideration of background concentrations and natural occurrence of metals). As for the next steps, Euromines will focus on the national implementation of the SML.

Metal Mining BREF (MIN BREF)

In accordance with the reviewed Industrial Emissions Directive, the drafting process of the Best Available Techniques (BATs) reference document (BREF) for the metal mining sector officially started in 2024. A BREF is the reference for setting emission limit values and issuing operating permits for industrial installations in EU Member States. It describes applied techniques, present emissions and consumption levels, techniques considered for the determination of best available techniques as well as BAT conclusions and emerging techniques. It is the result of the exchange of information carried within a Technical Working Group (TWG) composed of national authorities, ECHA, NGOs, industry, and led by the Commission (EU-BRITE).

During the second half of 2025, the MIN BREF process was fully dedicated to improving EU-BRITE’s questionnaire proposal. Over summer and until the beginning of November, Euromines provided 3 waves of comments on the first draft questionnaire while maintaining close engagement with the MIN BREF authors (EU-BRITE). The second draft proposal was released for comments on 12 November, and Euromines pushed its position during the workshop on questionnaire finalisation that followed (9-10 December).

In parallel, the second site visits took place in Austria in November 2025. Such field trips aim at providing on-the-ground insights to the TWG, by showing local conditions, emissions, techniques used and possible challenges. Representatives from EU-BRITE, European Commission (DG ENV), Member States (AT, ES, FR, HU, SE), NGOs (EEB), technology providers (CECE) and industry (Euromines) took part to the trip. The TWG was able to visit one Competent Authority along with 2 mines: Erzberg (Iron) and Mittersill (Tungsten). We trust that these visits gave valuable understanding of on-site realities to the TWG, and should be complemented with further visits showing other local conditions in different areas of the EU. We invite operators to get in touch with their national authorities and encourage them to organise such visits, to emphasise the diversity of the sector in the context of the MIN BREF.

Ongoing MIN BREF priorities relate to the identification of CBI fields in the questionnaire and KEIs for chemicals, supporting the drafting of the BREF descriptive chapters, and the preparation for the questionnaire testing period that will run from mid-January until mid-February. Euromines is contributing on all fronts, with the aim of obtaining a questionnaire that will reflect the diversity and complexity of the mining sector without increasing the data reporting burden on operators, to eventually collect appropriate data and draft a realistic MIN BREF document.

As for the next steps, the final questionnaire will be released to kick off the official data collection phase in the first half of March, for completion by selected operators by the second half of June. The ensuing data assessment phase will culminate in a workshop in Q4 2026, before the release of the first MIN BREF draft in Q1 2027.

Industrial Emissions Directive (IED) 2.0

A year and a half after the publication of the revised IED (15 July 2024), several aspects of the revision are still a work in progress, and the consequences of the new text are not all fully defined yet. While Member States are tasked to carry the implementation of the new IED by 1 July 2026, the Commission committed to delivering several implementing acts and decisions. After a consultation carried out earlier in 2025, which received Euromines’ feedback, the Commission released the reviewed draft BREF guidance on 19 December. Together with other associations, Euromines is currently reviewing the document and will provide its input during the upcoming Article 13 Forum (March 2026).

It is worth noting that the EU simplification efforts, and particularly the Environmental Omnibus of 10 December 2025, are impacting the task of the Commission. As the Omnibus foresees amendments regarding the Environmental Management Plan (EMS) (deletion of requirements for chemicals inventories, indicative transformation plans and obligation for independent audit), we can expect that the work on the EMS implementing act will now be able to move forward, and that the delegated act on the content of transformation plans content will be deleted.

Health & Safety

Euromines Safety Awards 2025

Held on 8 October 2025 in Brussels, the Euromines Safety Awards Ceremony celebrated outstanding safety achievements in mining. Keynote speaker Charlotte Grevfors Ernoult (EU-OSHA) stressed innovation and prevention as drivers of safer workplaces.

- Gold award – Atalaya Riotinto: Field Leadership Activities fosters proactive safety through audits, observations, and “Stop and Talk” sessions, tracked digitally.

- Silver award – Boliden Mineral AB: Blast Safe uses real-time access control and location’s checks to ensure all personnel are clear before blasting.

- Bronze award – LKAB Mekaniska AB: Safety Lock for Silo Renovation employs drones, VR, and remote locks to eliminate silo entry.

Social and Sectoral Dialogue

Euromines in conjunction with IndustriALL concluded the SODISEES project on 31 October 2025 after two years of collaboration, publishing a report on the importance of social dialogue. The report, “Social Dialogue for Sustainable Extractives Industries in Europe’s” central message: by working together, workers, employers, and public authorities can build stronger industries and secure good, sustainable industrial jobs for the future.

The report outlines concrete measures to strengthen social dialogue and accelerate sustainable practices in Europe’s extractive industries. Please find the completed report here.

Health & Safety on site visit

A two day visit was held in Poland where our Health and Safety committee members visited Lubin and Rudna Mining Plants from KGHM as well as an underground visit in Lubin Mine. The visit was an excellent opportunity to visit see a variety of flagship locations and machinery: discharge point, conveyor belt, remote control room, maintenance room, underground training area, soon-to-be-launched VR training centre.

Informal Coalition on Permitting

An informal coalition on permitting (ICP) has been established, jointly led by Euromines and IOGP. This broad alliance brings together diverse stakeholders who face significant challenges related to permitting procedures.

To better understand these issues, the coalition developed a tailor-made questionnaire aimed at identifying specific bottlenecks affecting companies. Based on the findings of the questionnaire, the coalition issued a joint statement calling for inter alia:

- A coherent and overarching permitting framework based on changes in underlying base directives.

- Streamlined procedures to reduce duplication and legal uncertainty.

- Adequate resources, capacity, and modern digital tools for national authorities.

- The introduction of enforceable time limits, digital tracking, and accountability mechanisms.

The work of the ICP is independent from RESourceEU and other initiatives but aims to provide an overarching picture of permitting issues – and map overlaps, shortcomings and contradictions that still need to be addressed. To that end, the ICP will organise a permitting dialogue roundtable with the Commission and publish a report on the permitting experience of its participating sectors.

Euromines visibility

In the second half of 2025, Euromines refreshed its website, transforming it into a comprehensive one‑stop shop for information about the mining industry in Europe. The Secretariat took part in more than 15 public events, acting both as speaker and moderator. With the cooperation of Euromines members, the team also organised two flagship events: the Euromines Safety Awards in October and the pilot edition of Mining 1.0.1. All these owned events were proudly sponsored by the SMI. In parallel, the Secretariat contributed to the development of programmes and topic‑specific agendas for several other high‑level initiatives.

On 4 July, Euromines Energy Committee visited the Werra potash plant, hosted by our German member K+S Gruppe. The visit focused on the Werra 2060 Project, exploring both the underground operations and the processing facilities, highlighting how innovation in raw materials production can contribute directly to the EU climate and sustainability objectives. The project’s key priorities include:

- Increasing energy efficiency across operations

- Reducing water consumption by transitioning from wet to dry processing

- Minimising tailings disposal and environmental impact

- Decarbonising production processes

- Investigating underground farming as a sustainable post-mining idea

The Werra 2060 Project stands as a concrete example of how Europe’s extracting industries can deliver on the continent’s climate neutrality goals, promote strategic autonomy, and actively engage with local communities, all whille preserving natural resources.

Alongside event‑driven engagement, the team continued to expand Euromines’ communication and outreach tools. Several new episodes of the Euromines podcast were recorded in 2025, with the first releases expected at the end of January. In addition, the Secretariat developed an internal and external communication strategy designed to reinforce its advocacy efforts and ensure greater alignment across the network.

Euromines members were equally active in shaping the political debate, participating in key high‑level fora ranging from the Delphi Economic Forum, to the Raw Materials Week, and Resourcing Tomorrow, among others.

Looking ahead, 2026 marks Euromines’ 30th anniversary — a milestone year that will bring new initiatives, celebrations, and updates.